Accounts Payable

"leave Accounting burden on us and feel free to Focus on your Core Business"

Accounts Payable refers to the outstanding invoices owed by the Business for the goods and services provided by it's Vendor. It is an important aspect for every business to analyse their short term liquidity position. It helps the management to understand how effectively they can cover their short-term obligations without any additional cash flows. The strength of an entity's AP can be assessed with the Accounts Payable Turnover ratio that helps the management/Investor to understand how effectively an entity manages its credit purchases and paying creditors. A higher payable turnover ratio is considered to be more favourable for businesses. Timely and effective AP process is crucial for improved cash outflow and business performance.

Our Accounts Payable outsourcing services are beneficial for businesses that want to identify and follow up on outstanding invoices more efficiently and want to streamline the overall AP processes while slashing the operational & administrative costs significantly. We strengthen your financial system by maintaining your accounts payable transactions with improved accuracy and efficiency.

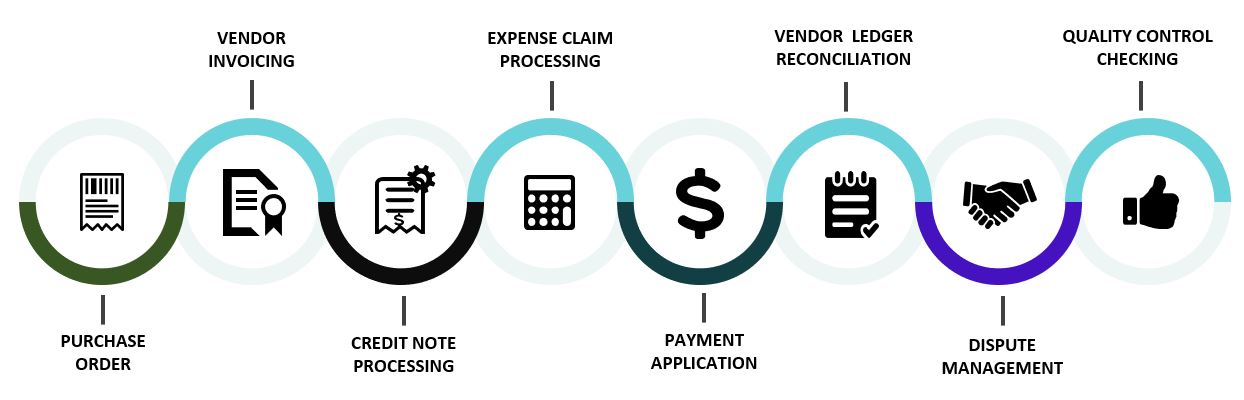

Our Accounts Payable Workflow Process

Purchase Order

Purchase order to potential vendor will be issued by our team of experts after thorough evaluation in terms of quantity, pricing, address, terms and conditions etc.

Vendor Invoicing

Vendor invoicing is cross validated and processed by us after evaluating the open purchase order & applying necessary adjustments like GST credit etc.

Credit Note Processing

We ensure that the credit notes have been received from respective vendor and processed in the system for revision against respective original purchase invoice.

Expense Claim Processing

Employee claims are processed by our team after cross verification of the approved expenses with external supporting evidence like an invoice.

Payment Application

Payment in Vendor ledger account is applied by our team against respective invoicing after considering the necessary adjustments like discount received, WHT (withholding tax) payable etc.

Vendor Ledger Reconciliation

Vendor ledger reconciliation is prepared and reconciled by us with external supporting document i.e. Vendor Confirmation Report.

Dispute Management

We feel privileged to support our valuable clients for any queries raised by the Vendor and perform corrective actions in Vendor ledger account.

Quality Control Checking

The complete process is supervised/monitored by our Subject Matter Experts that help us to deliver quality services exceeding your expectations.

Service Offerings

"We are a team of professionals offering best Accounts Payable services"

PURCHASE ORDER MANAGEMENT

PURCHASE INVOICE PROCESSING

CREDIT NOTE PROCESSING

EXPENSE CLAIM PROCESSING

PAYMENT APPLICATION

AP SUBLEDGER RECONCILIATION

DISPUTE MANAGEMENT

Benefits of AP Outsourcing

Here is why you should choose us as your Accounts Payable service provider

- Increased Efficiency

- Reduced Staffing Cost

- Reduced Administrative Overhead and Costs

- Focus on Core Business Areas

- Improved Payments

- Improved Vendor Relationship

Do you want to be a member of Adhira Financial Services family? Just contact us today!!