General Ledger Accounting

"we are ready to serve you with our quality accounting services"

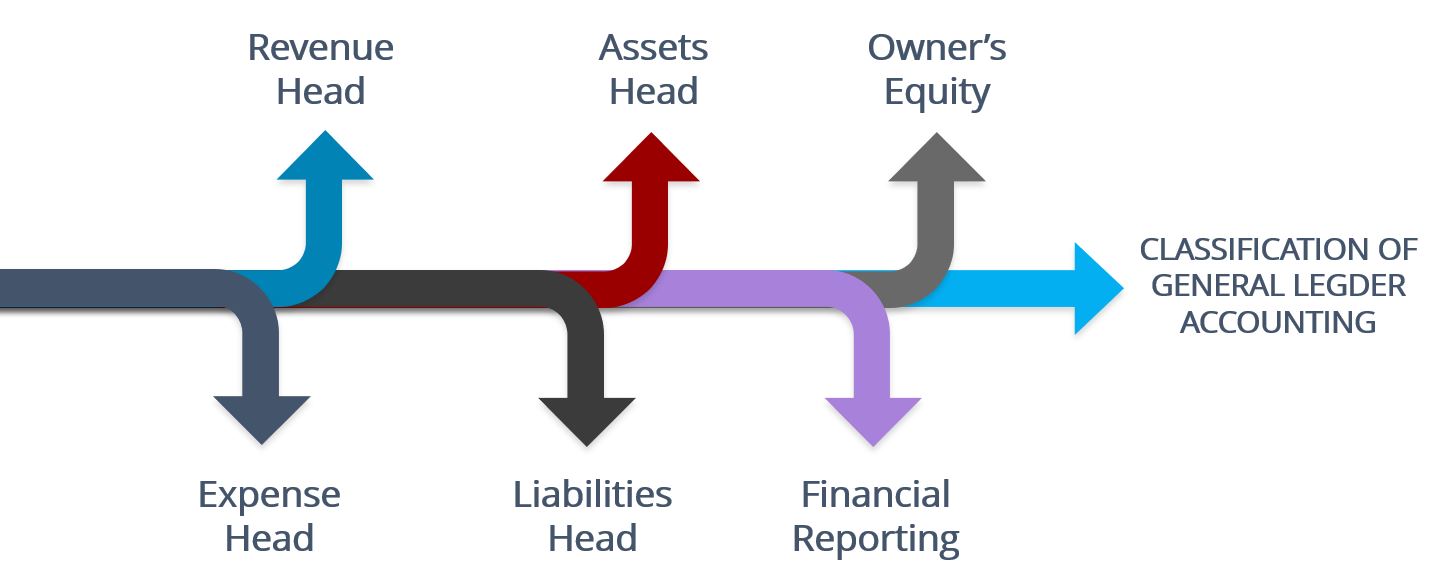

General Ledger refers to a central repository for all the financial transactions that occurs in a business on day to day basis. It is the base for preparing the trial balance and financial statements of a business. It is very important for every business to classify their financial transactions into appropriate accounting heads as per their nature like Asset, Liabilities, Owner's Equity, Revenue and Expense Ledger. It helps the management, auditors and key stakeholders to take their decisions based on financial position of an entity. Accurate financial position leads to the trust of key Stakeholders.

We strongly believe that the first step to gain the trust of key Stakeholders is to present the true and fair view of the financial statements. Our professional team has expertise in general ledger accounting that will help you to maintain your financial records in accurate manner. We classify your business transactions under appropriate accounting heads. We thoroughly review all the transactions and make sure that it reconciles accurately with it's supporting document & ledger. We understand the value of your time and money so we take every step to provide you best ROI from our services.

Classification of General Ledger

Revenue Head

We understand the nature of business and ensure that all income, either accrued or earned, is correctly processed under this head. (Eg :- revenue from operations, interest income, commission income etc).

Expense Head

All expenses either paid or accrued are managed by our team and processed on time within relevant accounting period under this head. (Eg :- operating expenses, non-operating expenses etc).

Assets Head

We understand the nature of transactions and process all the capital expenses, prepaid expenses, accrued income etc under this head alongwith classification of assets between Current and Non Current assets.

Liabilities Head

Classification of liabilities between Current and Non Current liabilities alongwith processing of all accrued expenses, deferred income etc under this head are well managed by our team.

Owner's Equity

To provide a clear picture of the proportion of the total value of claimable business assets, we ensure that necessary adjustments against Owner's Equity are accurately captured in the system.

Financial Reporting

We offer a wide range of financial reporting services like preparation of Trial Balance, Balance Sheet, Income Statement, Cash Flow Statement which is useful for Management, Auditors and Key Stakeholders to understand the progress of business over a specific period of time.

Service Offerings

We are a team of professionals offering best General Ledger Accounting services"

ACCRUALS

Accruals are expenses incurred or revenue earned during the period for which no invoice or payment is received by the end of an accounting period. We will maintain and process all accrual journals, reversals and their true up in account during the relevant accounting period.

PREPAYMENTS

Prepayments refer to the sum paid by a business in advance for the goods and services received later on. We will maintain all the prepayment bookings and their respective charge off to P&L account against relevant accounting period.

ADHOC JOURNAL

Adhoc JE refer to mistakes, errors, omissions that are identified post period closing (For Eg :- reconciliation adjustments, clerical bookkeeping error, missing bank charges, bank interest, dividend received etc). We will post all the adhoc journals on regular basis to avoid any potential impact on business numbers in later period.

FIXED ASSET REGISTER

FAR contains the information like asset class, quantity, life, gross value, accumulated dep, written down value of all the fixed assets that belongs to a business. We will maintain the FAR Scheduling and process all transactions like addition, disposals, depreciation during the relevant accounting period.

COMPARATIVE P&L REPORTING

Our team has expertise in analysing the P&L trends over the period of time like Month-To-Date, Quarter-To-Date & Year-To-Date. We will share the detailed commentary with key users for their further actions.

FINANCIAL REPORTING

We provide comparative financial reporting like Trial Balance, Balance Sheet, Profit & Loss account in a systematic way to the Management. This will help them to understand their business performance over a specific period of time.

Benefits of General Ledger Accounting

Here is why you should choose us as your General Ledger Accounting service provider

- Real Time Reporting

- Accurate Financial Reporting

- Increased Efficiency

- Cost Effective

- Focus on Core Business Areas

- High Quality Services

Do you want to be a member of Adhira Financial Services family? Just contact us today!!