Account Reconciliation

"get error-free reconciled accounts precisely matching with supporting document"

Account Reconciliation is the internal control process of ensuring account balances are correct at the end of an accounting period. Every business must reconcile all the balance sheet accounts that can contain a significant and material misstatement. This would help the entities to identify and post the necessary adjustments in general ledger on time & ensuring the completeness and accuracy of the financial statements.

We provide an expert reconciliation outsourcing alternative for small and mid-sized firms that demand accuracy, cost efficiency and regulatory compliances. This will help the entities to streamline their process. Our team thoroughly reviews all types of account reconciliation with the supporting document. We classify the open items under reconciled items and time gap items. Reconciled items are those that require an adjustment entry in books for eg :-excess accrual, short accrual, missing accrual, wrong JE booking etc. Time gap items are those that do not require any adjustments entry in books and will be reconciled in later period for eg :- Sub-ledger reports mismatch due to time gap. We process all the adjustments within the relevant accounting period to avoid any major impact on financial numbers in later period. We ensure that every account in general ledger is consistent, accurate and complete in all aspects.

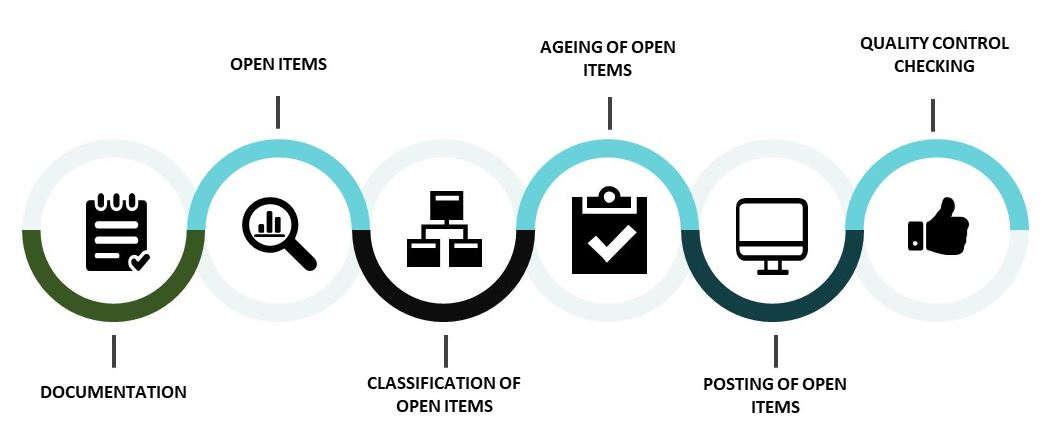

Our Account Reconciliation Workflow Process

Documentation

Our team of experts prepare the account reconciliation and validates it with supporting document like Bank Statement, Credit Card Statement, Sub Ledgers Reports, Intercompany Account Statement, Payroll Report (Long service leave, Annual leave) etc on the basis of nature of account.

Open Items

We analyse the general ledger balance with supporting document to find out the open items that refers to the difference between supporting document and general ledger balance.

Classification of Open Items

The open items are classified against respective heads like Reconciled items and Time Gap items which are shown on the reconciliation sheet as an actionable item.

Ageing of Open Items

We ensure that the reconciled items are shown under correct ageing category i.e. how old an open items are there in account. It will give an insight about the possible red account to the management.

Posting of Open Items

Once the open items that require an adjustment in books are identified, our team will prepare the journal entry and post them in respective account to match the general ledger balance with supporting document.

Quality Control Checking

The complete process is supervised/monitored by our Subject Matter Experts that help us to deliver quality services exceeding your expectations.

Service Offerings

"We are a team of professionals offering best Account Reconciliation services"

AR RECONCILIATION

Our AR/Customer ledger reconciliation service keeps track on all transaction with Customer like Customer invoice, receipt, discount etc. We ensure that unpaid Customer sub ledger reports are matching with the accounts receivable balance.

AP RECONCILIATION

Matching of accounts payable balance with unpaid Vendor sub ledger reports are well managed by our reconciliation team. We analyse the Vendor invoices, payments, credit note etc thoroughly from general ledger transactions.

INTERCOMPANY RECONCILIATION

We ensure that intercompany balance precisely matches with intercompany group statements to avoid any variance on consolidation level.

FIXED ASSET RECONCILIATION

Preparing the fixed asset reconciliation with all fixed asset movement like addition, disposal, accumulated depreciation, written down value, quantity, asset class, life of asset, asset description etc are perfectly managed by our team.

PAYROLL RECONCILIATION

We manage and reconcile the payroll account with the help of payroll reports like long service leave , annual leave, gratuity, superannuation etc.

GENERAL LEDGER RECONCILIATION

Our general ledger reconciliation services ensure that all the accruals, prepayments, provisions, deferred revenue, deferred expenses etc matches precisely with their relevant supporting.

BANK RECONCILIATION

Our team has specialization in the analysis and reconciliation of all financial transactions in bank accounts on regular intervals with bank general ledger balance.

BUSINESS SPECIFIC RECONCILIATION

Our team is open and has expertise in preparing any kind of business specific reconciliation like Credit Card reconciliation, Third Party reconciliation, Bonus calculation, Interest calculation etc as per business needs.

Benefits of AR Outsourcing

Here is why you should choose us as your Accounts Reconciliation service provider

- Error-free Reconciliation

- Real Time Adjustments

- Accurate Reporting

- Increased Efficiency

- Reduced Staffing Cost

- Competitive Pricing

Do you want to be a member of Adhira Financial Services family? Just contact us today!!